Case Study

Hat Creek Construction & Materials is saving valuable management time with EROAD Electronic IFTA

Business Need

Operations at Hat Creek Construction & Materials include trucks that travel throughout California and to other western states hauling raw materials or construction equipment. The company is subject to filing IFTA (International Fuel Tax Agreement) and Oregon state fuel tax reports.

Relying on drivers to accurately record fuel purchases and state mileages was proving to be consistently problematic and led to a time consuming and error-prone process for preparing and filing IFTA quarterly fuel tax returns manually.

Solution

In December 2016, Hat Creek Construction & Materials implemented EROAD Electronic IFTA and installed in-cab devices in trucks that traveled throughout California and to other states requiring the company to file IFTA and Oregon state fuel tax reports.

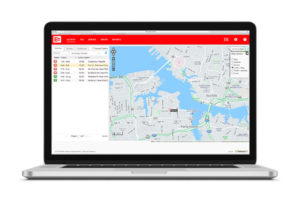

With EROAD’s mileage information on the trucks is automatically captured and securely transmitted to its Depot secure web-based application, eliminating the need to review driver records and manually enter information. With EROAD mapping and geo-fencing capabilities, accurate exempt miles in each jurisdiction, including distance, location, and state line crossing information, is reported.

Benefits

With EROAD Electronic IFTA, Hat Creek Construction & Materials is streamlining fuel tax management. While previously the quarterly filing process took as much as two weeks, the EROAD solution has reduced that time to just ten minutes.

EROAD Electronic IFTA is eliminating the time-consuming need at Hat Creek Construction & Materials to recreate trips and is removing driver data entry requirements by automatically capturing and recording accurate mileage and fuel purchase information.

“EROAD streamlines and improves the accuracy of our IFTA filing. Before we adopted EROAD Electronic IFTA we prepared quarterly returns manually, and it could take two weeks to get all of the information and to recreate each trip. With EROAD it takes ten minutes. The solution also eliminates driver errors entering state mileages and fuel purchase data because that information is captured automatically.”

John Sammons

Hat Creek Construction & Materials, Inc.

Hat Creek Construction & Materials, Inc., based in Burney, California, provides heavy construction, commercial and residential construction, concrete and paving, portable rock crushing, culvert and pipe installation, equipment rental and trucking services. Its fleet of 35 heavy-duty trucks operates in several western states. The company also manufactures and supplies a wide a range of construction and landscape materials.

Hat Creek Construction & Materials, Inc.

Industry:

Construction